- Home

- Information and Advice

- Early Education and Childcare

- Help to pay for early education and childcare

Help to pay for early education and childcare

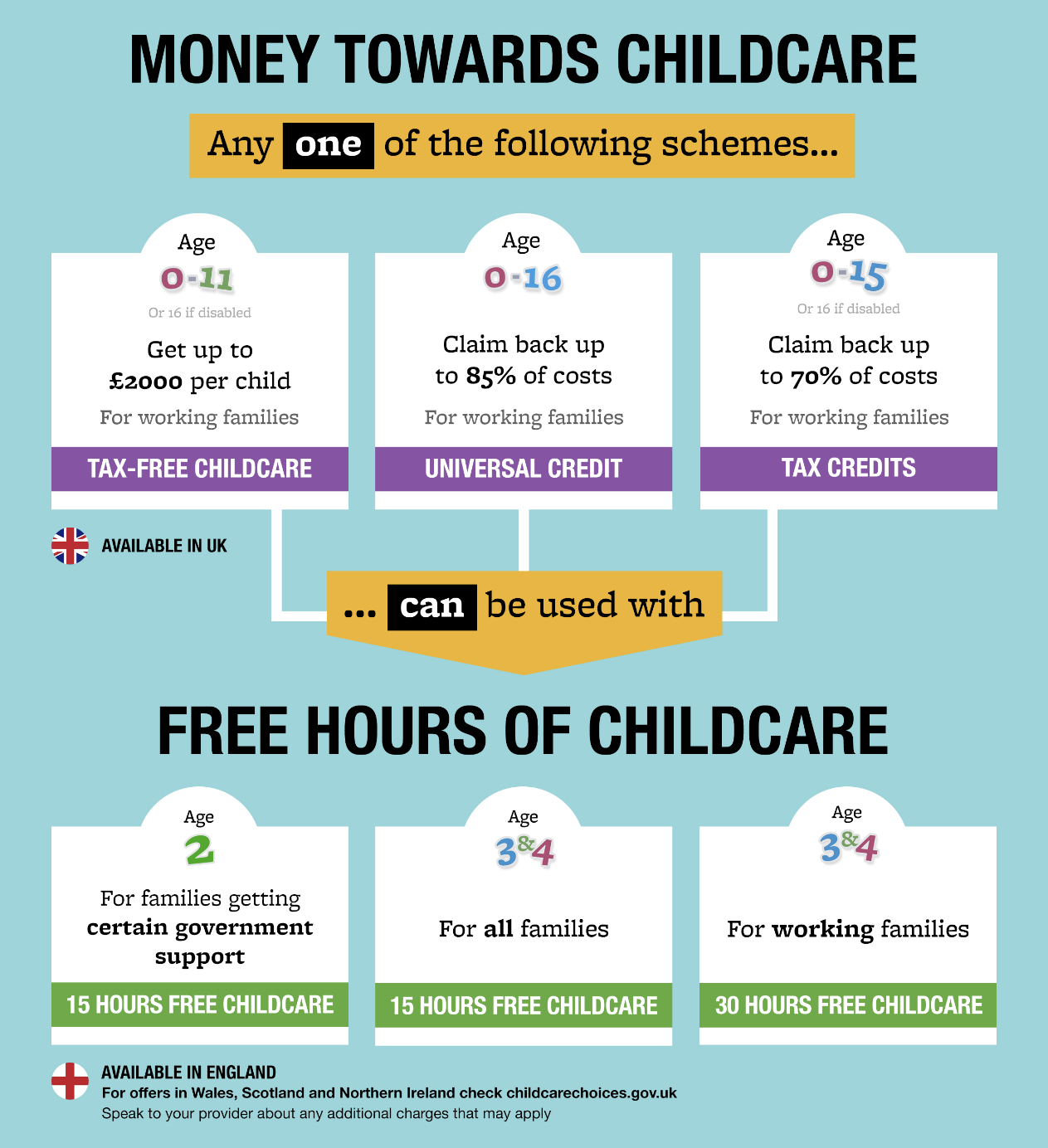

Financial support is available to parents towards the cost of childcare through a number of government support schemes. Some of these schemes can be used together. Find out more below:

Funded early education and childcare hours

These support parents to reduce their childcare costs by the number of funded hours per week their child is eligible for.

The number of hours you're entitled to depends on the age of your child and your family circumstances.

Tax Free Childcare - up to £2000 per child

If you're eligible, this covers up to 20% of your childcare costs

- For working families, including the self-employed, in the UK

- Earning under £100k and an average of £167 per week (equal to 16 hours at the National Minimum or Living Wage) each over three months

- Who aren't receiving Tax Credits, Universal Credit or childcare vouchers

- With children aged 0-11 (or 0-16 if disabled)

- For every £8 you pay into an online account, the government will add an extra £2, up to £2,000 per child per year

To apply for tax free childcare, visit the .gov.uk application page

Universal Credit for childcare

Supports up to 85% of childcare costs:

- For working families claiming Universal Credit, in England, Scotland, Northern Ireland and Wales

- With children under 17*

- Up to 85% of eligible childcare costs

- Who aren't receiving Tax-Free Childcare

* The childcare cost element in Universal Credit is paid up to the end of August following the child's 16th birthday.

To find out more and apply, visit the .gov.uk universal credit for childcare page

Support while you study

- Weekly payments from Care to Learn if you’re at school or sixth-form college

- Help through your college if you’re in further education

- A weekly grant if you’re in full-time higher education

To find out more and apply, visit .gov.uk care to learn page

Using the schemes together

Some of these schemes can be used with others:

Do you know about Disability Access Funding?

There is funding available for your chosen early education and childcare provider to support your child, if they have a disability or special educational needs. To find our more click on the button below.