Find out more

To find out more about the support you can get, visit the Best Start in Life parent hub eligibility checker.

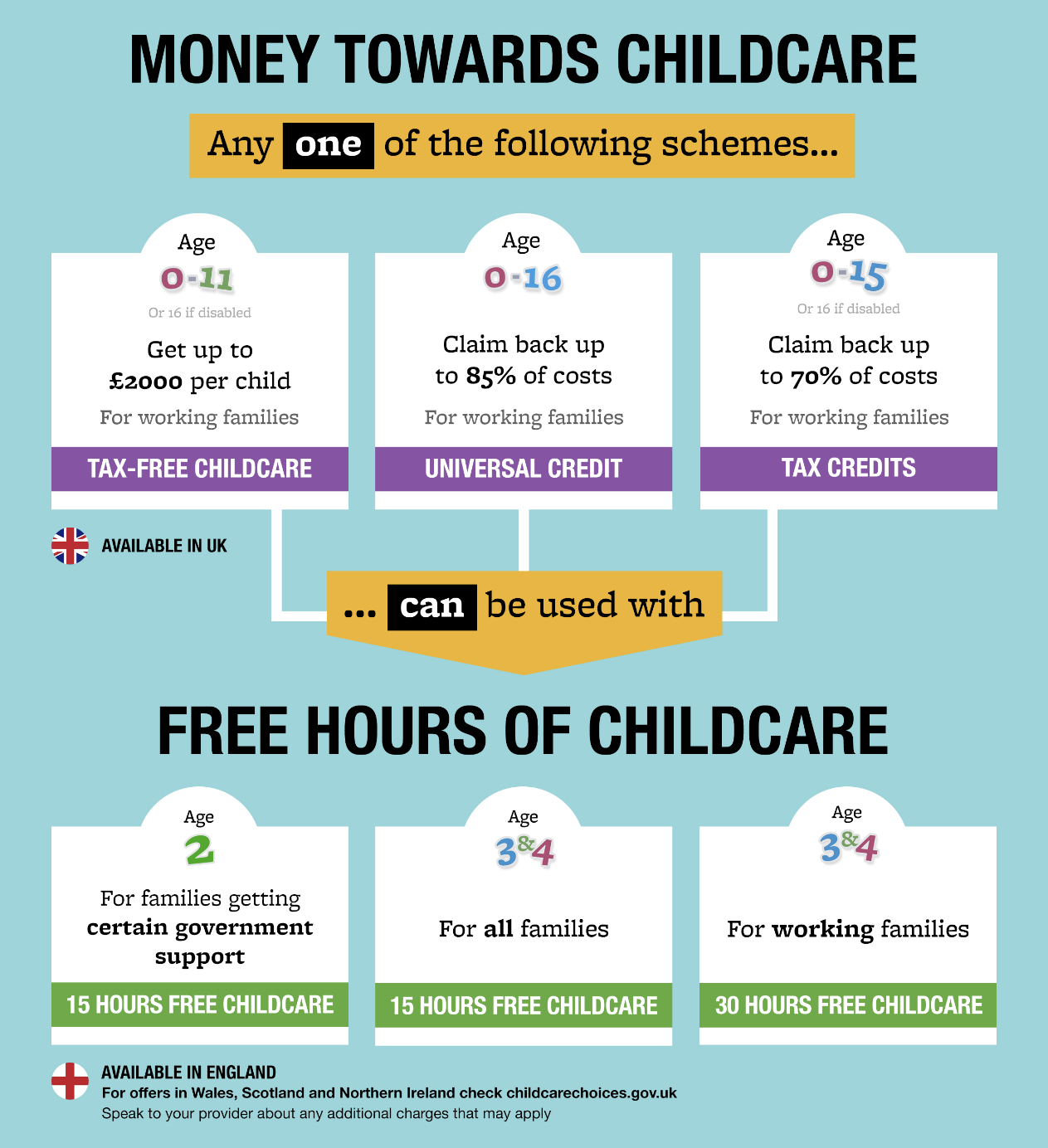

Financial support is available to parents towards the cost of childcare through a number of government support schemes. Some of these schemes can be used together. Find out more below:

These support parents to reduce their childcare costs by the number of funded hours per week their child is eligible for.

The number of hours you're entitled to depends on the age of your child and your family circumstances.

If you're eligible, this covers up to 20% of your childcare costs

To apply for tax free childcare, visit the .gov.uk application page

Supports up to 85% of childcare costs:

* The childcare cost element in Universal Credit is paid up to the end of August following the child's 16th birthday.

To find out more and apply, visit the .gov.uk universal credit for childcare page

To find out more and apply, visit .gov.uk care to learn page

Some of these schemes can be used with others:

To find out more about the support you can get, visit the Best Start in Life parent hub eligibility checker.

There is funding available for your chosen early education and childcare provider to support your child, if they have a disability or special educational needs. To find our more click on the button below.